What Is the Difference Between Mineral Rights and Surface Rights?

If you’re a landowner or are considering selling or leasing your mineral rights, one of the most important concepts to understand is the distinction between mineral rights and surface rights. In the United States, land ownership can be legally divided into different types of rights, meaning it’s entirely possible to own the land above ground, but not the resources beneath it.

This division, known as a “split estate” or “severed estate,” is not just legal jargon; it has real-world implications for how land is used, developed, and valued. Below we break down what these two rights are, how they differ, and what it means for you.

Surface Rights: Ownership Above the Ground

Surface rights refer to the ownership and use of the land’s surface. If you own the surface rights to a piece of property, you have the legal authority to build structures, grow crops, raise livestock, install fencing, or use the land for recreational or residential purposes.

Surface rights, however, typically do not include the right to access or extract any minerals, such as oil, gas, coal, or precious metals located beneath the surface. That’s where mineral rights come into play.

Mineral Rights: Ownership Below the Surface

Mineral rights, also called subsurface rights, grant the legal authority to explore, extract, and sell the minerals beneath a parcel of land. These minerals can include oil and natural gas, coal, metals (e.g., gold, copper, iron), sand & gravel, lithium, or other any other extracted material of value.

Mineral rights can be severed from surface rights, meaning one party may own the land above, while another owns the resources below. This separation is common in oil- and gas-rich states like Texas, Oklahoma, New Mexico, and North Dakota. In highly productive areas like the Permian Basin in Texas, 99%+ of all real estate is severed.

Severed vs. Unified Estates

A unified estate is when the same person or entity owns both surface and mineral rights to a property. This used to be more common, but over time, landowners or institutions have sold their surface rights while retaining mineral rights (or vice versa), resulting in a severed estate.

This severance occurs over time because the two asset classes — surface interests and mineral interests — are so fundamentally different in terms of their utilization. As a result, they are of interest to entirely different parties. Surface interests are of utility to residential & commercial developers, ranchers, and individual homeowners, whereas mineral interests function more as investment products in the industry related to the resource contained within the parcel — often oil and natural gas in the United States.

In a severed estate, the mineral estate is considered dominant in most jurisdictions, particularly in oil and gas-producing states. This means that the mineral rights owner (or lessee) has a legal right to access the surface of the land as reasonably necessary to explore and produce minerals, even if they don’t own the surface. This can come as a surprise to surface owners who are unaware their property is part of a split estate.

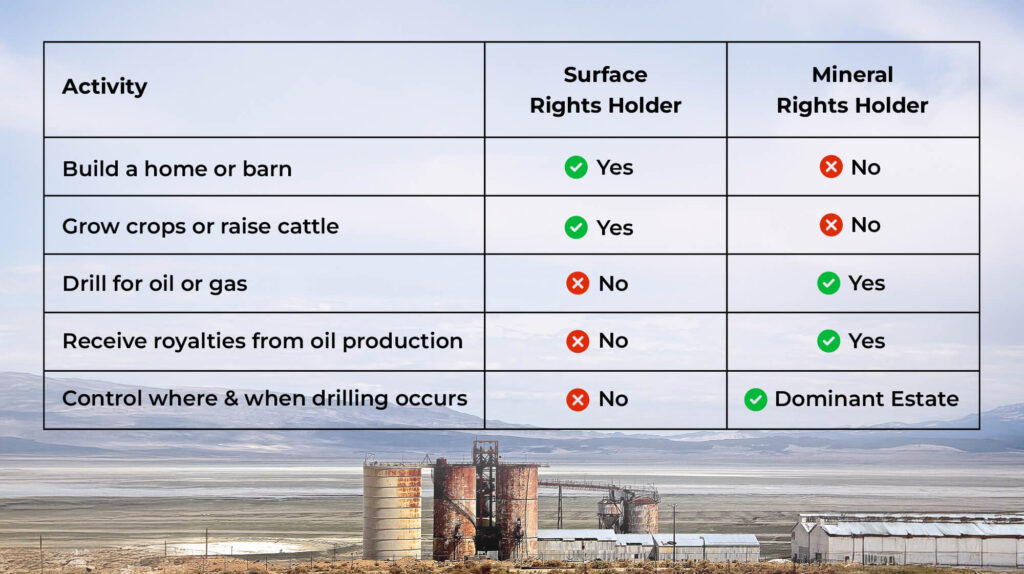

Understanding who holds which rights helps clarify what activities are permitted:

Even if the mineral rights owner doesn’t own the surface, they often have the right to bring in equipment, drill wells, build access roads, and install pipelines, as long as it’s within the bounds of reasonable use.

What About Leasing?

In many cases, the mineral rights owner chooses to lease those rights to an oil and gas company. In a typical lease agreement:

- The mineral rights owner (lessor) grants the right to explore for and produce minerals.

- The oil and gas company (lessee) pays a signing bonus, royalties, and possibly rental payments to the mineral rights owner. The royalty, often around 12.5% to 25%, is a share of the revenue from produced resources.

- The surface owner will not receive any royalty payments unless they also hold the mineral interests. However, if drilling or exploration activities significantly damage or impact the utility of the surface interest owner’s land, they are likely eligible to receive surface damages for this activity in order to compensate for the loss.

Why This Matters

Understanding the difference between mineral and surface rights is essential for several reasons:

- Valuation: If held in unison with the surface rights, mineral rights can significantly increase the overall value of a property.

- Negotiations: If approached by a company to lease or buy mineral rights, you need to know what you own.

- Land Use Conflicts: Disputes can arise when surface owners feel their land use is being disrupted by drilling or exploration.

Mineral and surface rights might occupy different layers of the same land, but they can’t be treated as an afterthought. If you’re uncertain about what rights you own, or what your rights mean, it’s worth taking the time to investigate and get professional guidance.

At Allegiance Oil & Gas, we work with individual mineral owners and small family offices to help navigate these issues, whether you’re looking to lease, sell, or better understand your ownership.

Have questions about your mineral rights or want to explore your options? Don’t hesitate to contact us. We’re here to help you make informed, confident decisions about your land and legacy.