Leasing Your Mineral Rights: Key Terms To Negotiate

If you’re a property owner and you’ve been contacted by an oil and gas operator about leasing your mineral rights, it’s essential to understand the process, where you may have negotiating power, and the terms that could most significantly impact your financial and legal standing down the road. Although being leased is almost always a good thing, you should never sign a lease without a careful review and negotiation.

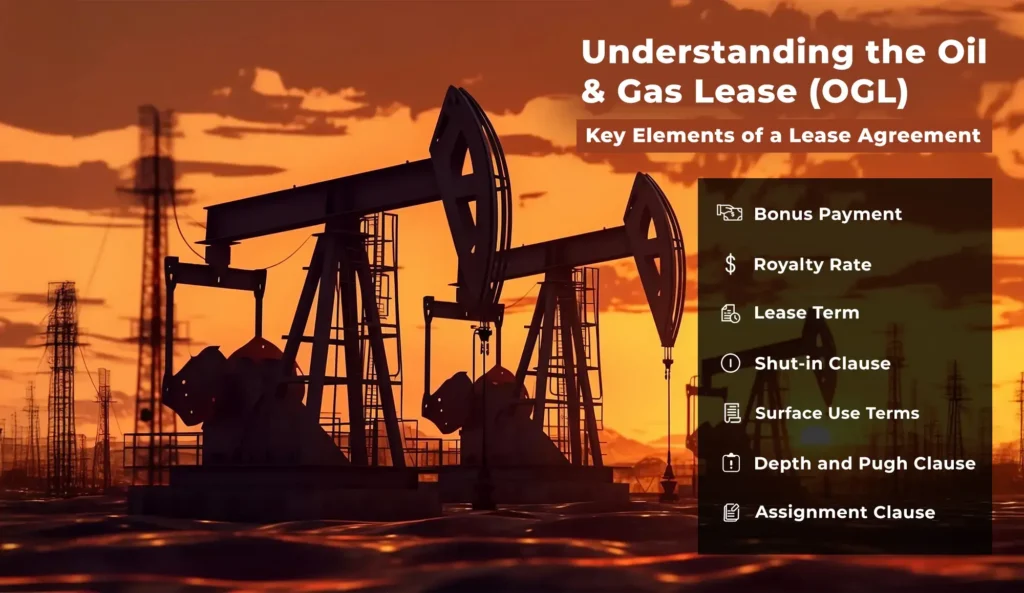

Understanding the Oil & Gas Lease (OGL)

An Oil & Gas Lease (OGL) is a contractual agreement that allows an operator to explore and extract hydrocarbons from beneath your property in exchange for compensation. These leases typically consist of key provisions that define the rights and obligations of both the lessor (mineral owner) and the lessee (operator).

Defining Key Lease Terms

Before discussing negotiation, let’s first establish definitions for the most common terms in an OGL:

- Bonus Payment – A one-time upfront payment to secure the lease.

- Royalty Rate – The percentage of production revenue paid to the mineral owner.

- Lease Term – The primary duration of the lease (e.g., 3-5 years) and any extension options.

- Shut-in Clause – Defines conditions under which the operator can suspend production while retaining the lease.

- Surface Use Terms – If you also own the surface rights, this dictates how the land can be accessed and utilized.

- Depth and Pugh Clause – Determines if and how unused depths or acreage revert to the owner if drilling does not occur on them within the lease term.

- Assignment Clause – Describes if and how the lease agreement can be transferred to another company.

The Most Important Lease Terms To Negotiate

Generally, the first draft of an OGL will be supplied by the operator seeking to lease your acreage, leaving you to review the terms therein, negotiate where appropriate, and ultimately finalize & sign. For common lease terms, here are some general rules-of-thumb:

- Royalty Ranges: Royalty rates should typically be between 12.5% and 25%, with relatively few exceptions. Higher rates benefit the mineral owner (lessor) and lower rates benefit the operator (lessee). The exact rate within the 12.5% to 25% range will depend on your region – and your negotiation. If your area is highly sought-after for drilling (think “major basins / plays” like the Permian, Eagle Ford, etc.) then you are more likely to be towards the top end of this range. If drilling occurs less frequently or densely in your area, you are probably looking toward the lower end. Any proposed royalty rate outside of the 12.5% to 25% range is typically a major red flag, demanding a clear explanation; if you see this, you are possibly negotiating with someone inexperienced or looking to take advantage in some way.

- Primary Lease Term: These are usually 3 to 5 years, often with an optional extension period. Obviously, shorter primary terms benefit the mineral owner and longer terms benefit the operator, giving them more time flexibility. Generally, primary lease terms should increase and decrease in correspondence with the lease bonus payment, not the royalty rate, as the lease bonus is guaranteed while drilling activity is not.

- Bonus Payments: These vary tremendously based on market demand and location, so it is difficult to create any blanket rules-of-thumb – however, you should consult with other owners who have been leased nearby, if possible, or a disinterested professional familiar with your area, to cross-reference any bonus amount proposed in order to assess whether it is in-line with market or not.

- Depth and Pugh Clause: It is important that your lease is written in such a way that you (the mineral owner) are allowed to re-lease as many of your acres and depths as possible in the event that the operator fails to drill on them by the end of the primary lease term. If your Depth & Pugh Clause does not aggressively return the acreage to you, it is possible that an operator will hold captive a large amount of your productive acreage for the 30+ year life of a single producing well, costing you potential lease bonuses & royalties from incremental production.

- Assignment Clause: It is common for an operator to require a lease to be broadly assignable, and this is not in-and-of-itself a red flag. However, if you see this term in your lease, you may wish to inquire with the lessee as to what, if any, plans they have to assign the lease as of the time of your signature. You will sometimes learn that the company leasing from you is in fact a contractor working for a larger operator and plans to collect and assign numerous leases in the area to the larger operator. Although this is also somewhat common, it will be useful for you to know the name of the operator that will ultimately be drilling on your acreage.

Less Focal (But Negotiable) Terms

- Gross vs. Net Royalty: Operators may deduct post-production costs; a “gross proceeds” clause ensures your royalty is calculated before these deductions. What is appropriate depends entirely on your region, so if this is a material consideration for your lease, you should consult a professional.

- Continuous Development Clause: Requires the operator to drill additional wells to maintain the lease. These are favorable to the lessor and should be strongly considered if the operator is leasing a very large number of acres.

- Indemnity Clause: Protects the mineral owner from liabilities due to operational accidents. This benefits the mineral owner and should be included in every OGL signed. This is usually boilerplate language that will automatically be included by the operator at the time of sending over a proposed OGL in the first place, but if this is not present, this should be requested.

Remaining Lease Terms

Most other OGL terms are less significant to a negotiation than those above, but ALL terms in your OGL should be carefully reviewed to ensure they are generally reasonable and pass the sanity-check of a rational person (you). As an example, although uncommon, if your OGL allowed wells to be shut-in for egregiously long periods of time while still holding your lease, this would be a red flag and would require explanation from the operator.

Conclusion

Generally, all OGLs are negotiable to some degree, so mineral owners should feel empowered to dig into the document and press back on any unfavorable terms. By taking a proactive approach to the leasing process, mineral owners can ensure they secure agreements that deliver lasting value while safeguarding their assets.